On July 14, 2021, Senate Majority Leader Chuck Schumer introduced a discussion draft of the “Cannabis Administration and Opportunity Act”. The bill is authored and sponsored by Schumer, along with Senators Cory Booker and Ron Wyden. Though the bill is unlikely to become law in its current form, it is significant that the Senate Majority Leader and chairmen of the Finance Committee is sponsoring such a bill. The framework hints at what may eventually become law as some sort of federal decriminalization is inevitable.

Below are the main bullet points as they would affect cannabis business owners, plus some editorializing:

- The bill would need 60 votes in the senate, or all democrat votes + 10 republican votes. The bill proposed will almost certainly not pass in its current form.

- Top line – the bill would remove cannabis from the Controlled Substance Act and transfer regulation from the DEA to ATF, FDA, and TTB. Basically, it puts it in the same category as cigarettes and alcohol from a governing standpoint.

- States may choose to retain cannabis prohibition laws. However, a state may NOT prohibit the interstate commerce of cannabis transported through its borders for lawful delivery into another state. Legal California weed could be shipped to Vermont. This will open up a lot of cans of worms.

- In legal states, illegal “cannabis diversion” is defined as unlawful possession, production, distribution, purchase of 10+ lbs. I believe this means the Michigan (and other loosely regulated) caregiver systems would be able to more or less stay intact.

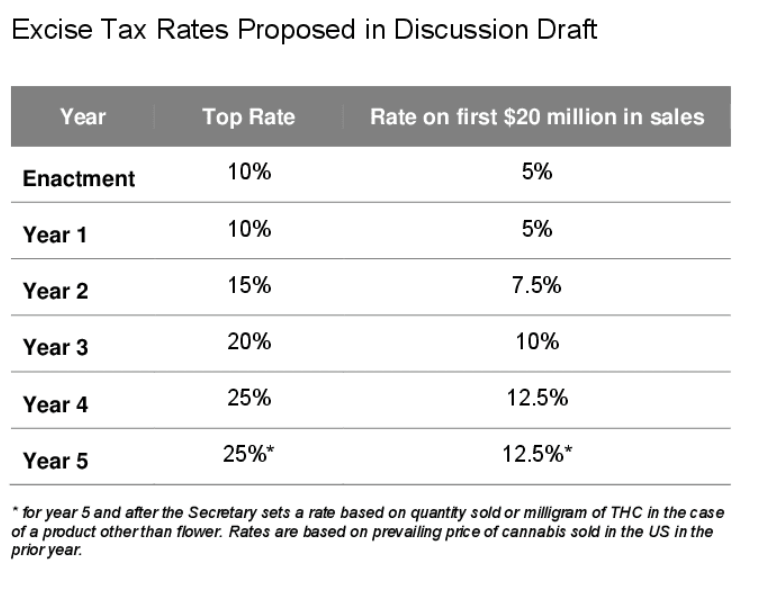

- TAX: eventually excise tax would max out at 25% – however it would be half that for the first $20MM in sales. This would roll out over a 5-year period. See table 1 below.

- Though there will be a federal excise tax, once descheduled and removed from the Controlled Substance Act, prohibitions under 280E would no longer apply. 280E has acted as an “unofficial” tax on legal cannabis – I’m interested to see if the excise tax will offset 280E – I think most cannabis businesses (especially retail) will end up paying less in tax.

- The law caps the amount you can buy at a store to 10 oz.

- Minimum age to buy is 21+

- Bill opens up the ability to do research involving cannabis – mainly where the cannabis being studied has to come from. This cuts a lot of red tape and will be a boon many understudied cannabis related topics.

- There are several social steps – The bill would expunge federal non-violent cannabis convictions. States could still keep cannabis criminals in jail under state laws.

- Removes ability of federal agencies to use cannabis as a basis for denying or rescinding security clearances, immigration stuff, some other benefits.

- Wholesalers must register with FDA and be permitted federally. Not much discussion on what that registration/permitting process would look like.

- FDA would be charged with making most of the nitty gritty rules – and establishing individual legal/tax treatment of the many ways THC can be produced, packaged, and sold.

- A federal track and trace program would be established. Some discussion on how a single fed system could replace the complex patchwork of state seed to sale systems.

- Replaces “marijuana” and “marihuana” with “cannabis” in codes and regs. (Though not that big of a deal, this has been a personal annoyance of mine for years.)

- Though not specifically addressed, normal banking and credit functions would open up.

Table 1

Conclusion

I think overall it is a decent proposal for business owners. The biggest gains would be the elimination of 280E for cannabis businesses and the benefit of normal banking/lending.

The ability to sell across state lines will cause the biggest shake ups and would be the next step for international commerce. The states with the cheapest electricity and the best tax incentives would likely become the main hubs of production.

In any case, the bill will face strong headwinds on both sides of the Senate. Senator Charles Grassley of Iowa, the top Republican on the Judiciary Committee said “It’s important that we have robust research and fully understand the good and the bad of marijuana use, especially in young people and over the long term.” Senator Jenne Shaheen, Democrat of New Hampshire was quoted, “There is still not enough data on marijuana use and whether that is a gateway drug in my mind to be able to make a decision to legalize it,” and added that New Hampshire faces “a significant substance use disorder problem.”

These are ridiculous arguments as cannabis research has been stymied for decades by the very bad faith laws this bill hopes to reverse and there is zero evidence that the nation’s opioid epidemic has be exacerbated by cannabis. The limited research available strongly suggests that cannabis can be a “gateway drug” to get off of opioids.1

President Biden has said he supports decriminalizing cannabis, but he is generally more conservative than most Democrats. The White House fired multiple staff members this spring over their use of cannabis.